Welcome to the Q1 update of 2023, with an up-to-date view of the commercial property market in West London

Featured in this issue: Market Summary, Take-Up, Q1 Headlines, Data on fitted space lettability, For Sale Hermes £195 million portfolio and Planning & Investment in west London.

OVERVIEW Q1 – West London Office Market

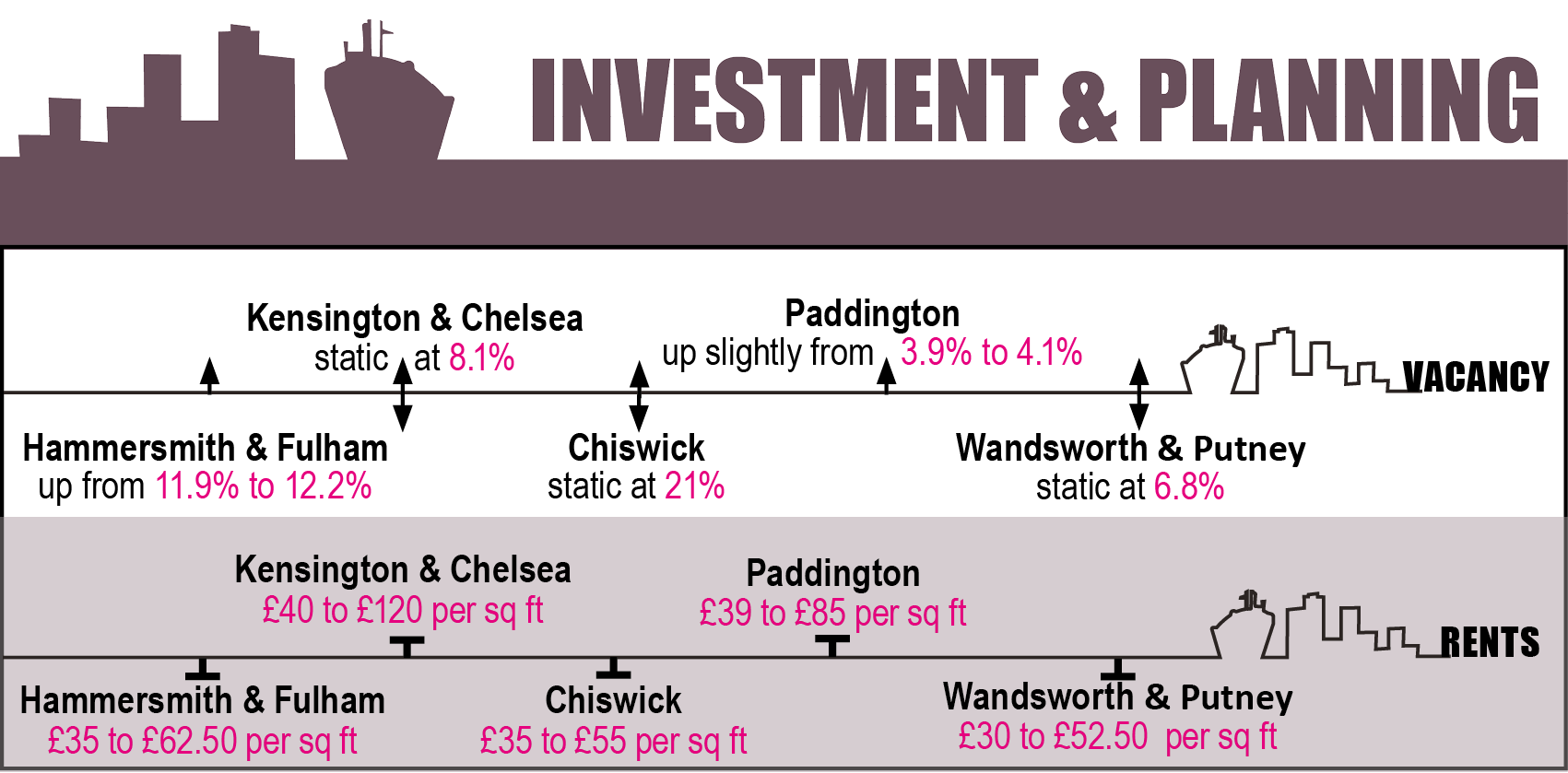

The west London office market in Q1 of this year has been a tale of two parts, with some notable occupier deals in Paddington & Kensington at record rents contrasted against lower demand further west, in Hammersmith to Chiswick. In Chiswick, vacancy levels remain over 20% compared to just 4% in Paddington.

In the capital markets, several larger office investments have come to market in the last few months in west London but buyers have been cautious due to continued poor take up and concern over falling rents some of these sales have been pulled. The market continues to see a squeeze on capital values whilst interest rates increase and rental values soften.

In the occupier market, the activity remains at the sub 10,000 ft with few requirements above. Of the lettings being transacted, there is a clear increase in the number of deals for fitted space as opposed to the traditional non-fitted. Occupiers are attracted to the ready to occupy space with flexible leases by the low cap-ex and speed of moving versus the traditional fit out process.

KENSINGTON

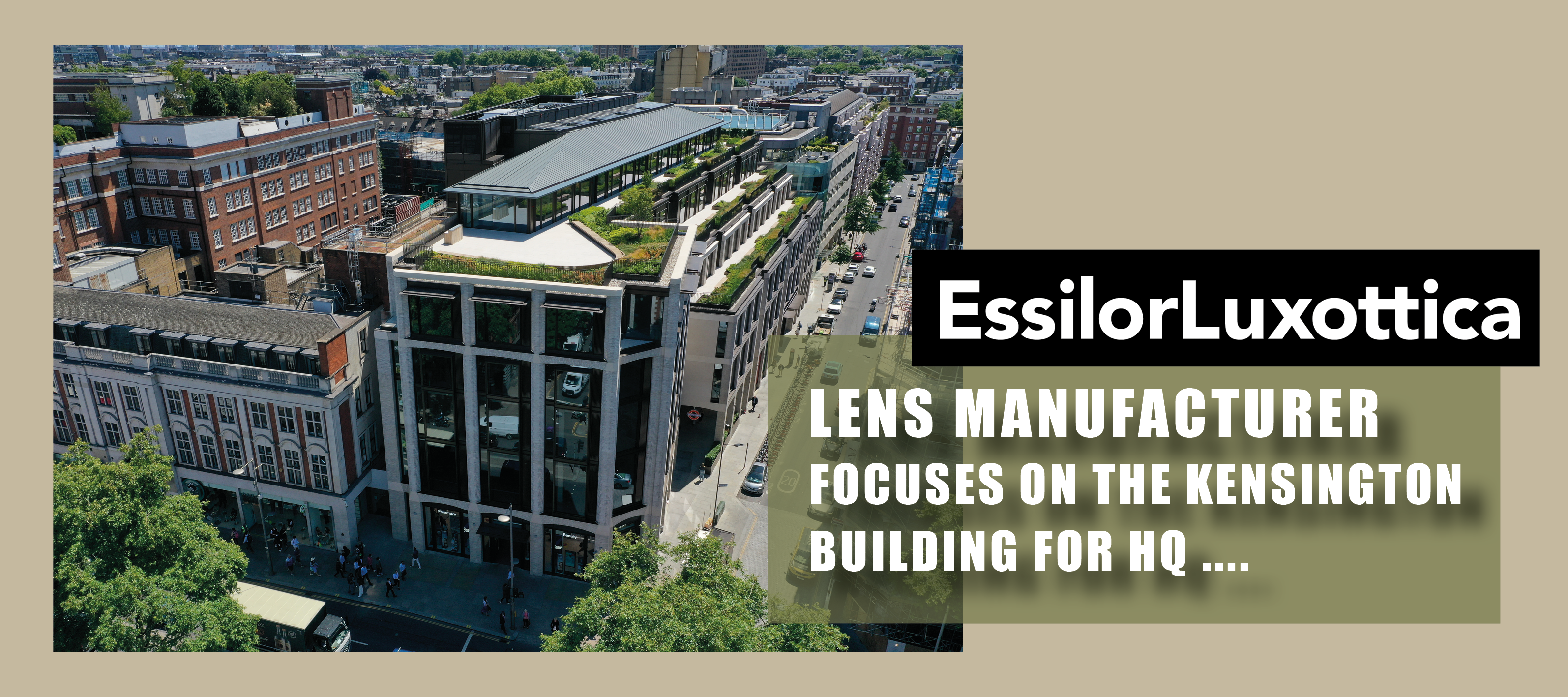

At The Kensington Building W8 EssilorLuxottica eye-wear manufacturer, took 22,931 sq ft on the 2nd floor at circa £85 per sq ft. Manchester United signed a 10 yr lease for the entire top floor of 16,000 sq ft plus a roof terrace. On the 4th floor Ilex Capital has taken 7,822 sq ft. Both deals were rumoured to be around £115 per sq ft setting a new record for the Kensington market.

Read more in Headlines…

SHEPHERD’S BUSH

Martha Hunt Galvan model (above right) Lily James & Sienna MIller (above left)

Bright Horizons, the nursery group, agreed a 25 yr term on 214 -216 Goldhawk Road W12, for the entire demise of 7,112 sq ft at £160,000 per annum.

Galvan London, favoured by stars for the red carpet like Lily James & Sienna Miller signed a 5yr lease at Phoenix Brewery W10 taking 1,283 sq ft for £43.50 per sq ft.

HAMMERSMITH & FULHAM

At Broadway Studios it’s all about style & fashion, Laura Ashley agreed a 10 yr lease on 3,948 sq ft at £43.50 per sq ft the well known 80’s fashion & interiors brand and Mos Mosh, fashion jeans brand, took a further 1,408 sq ft for 5 yrs at £42.61 per sq ft.

On the riverside at Thames Wharf Studios, current tenants expanded, taking ground 1,703 sq ft at £59.50 per sq ft & mezzanine 1,283 sq ft for £49.50 per sq ft for 18yrs.

And other existing tanant also grew taking on additional 2,209 sq ft at £59.50 for 10 yrs.

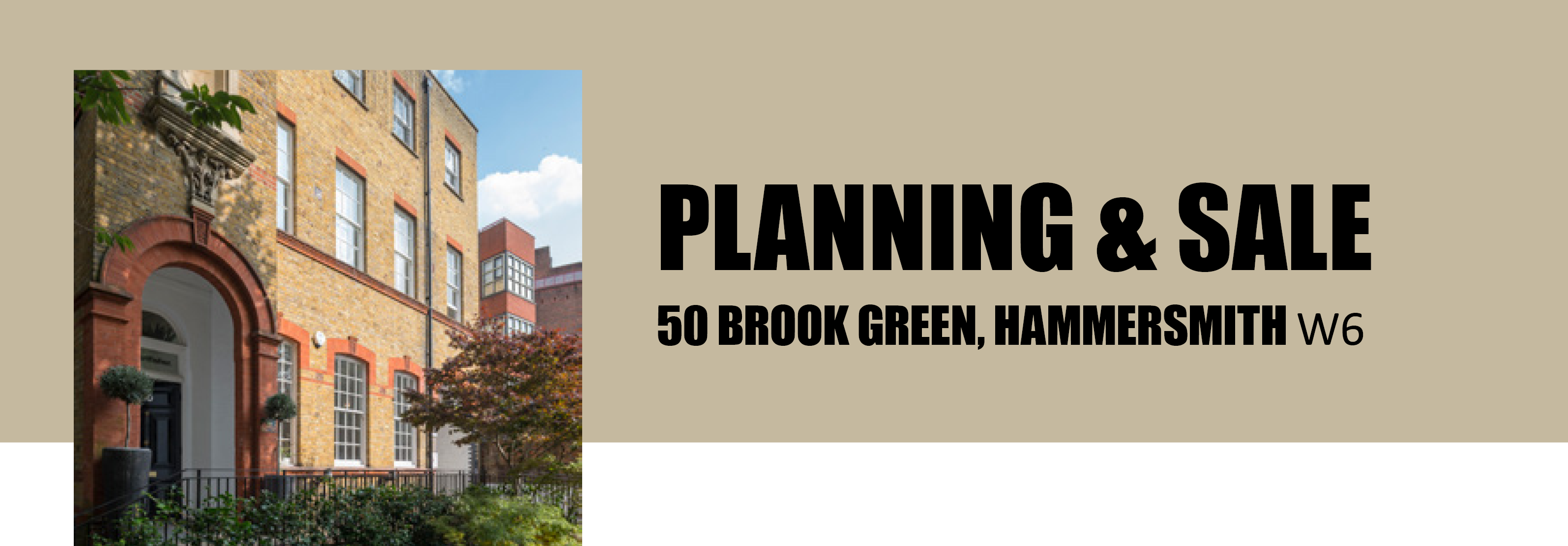

50 Brook Green W6 have just sold the freehold to an undisclosed US Fund, having gained planning for change of use from office to 33 residential units. Sale price £22m or £353 per sq ft

Read more in Headlines…

CHISWICK

Frost Meadowcroft completed on The Penrose, Bollo Lane Chiswick. Anytime Fitness, the world wide gym & fitness brand took 6,440 sq ft at £20 per sq ft for a 15 yr term.

PARK ROYAL

Legal & General sold First Central for £18 million or £110.69 per sq ft. The property is a

162,612 sq ft mixed use building.

Read more in Investment & Planning…

West London Office News

VIRGIN MEDIA 02

Telecoms giant Virgin Media O2 have taken 83,000 sq ft of office space across seven floors at 3 Sheldon Square Paddington. With a multi-million-pound investment a new state-of-the-art UK headquarters in Paddington Central will be created which will see existing sites in both Hammersmith and Slough close by the end of 2024.

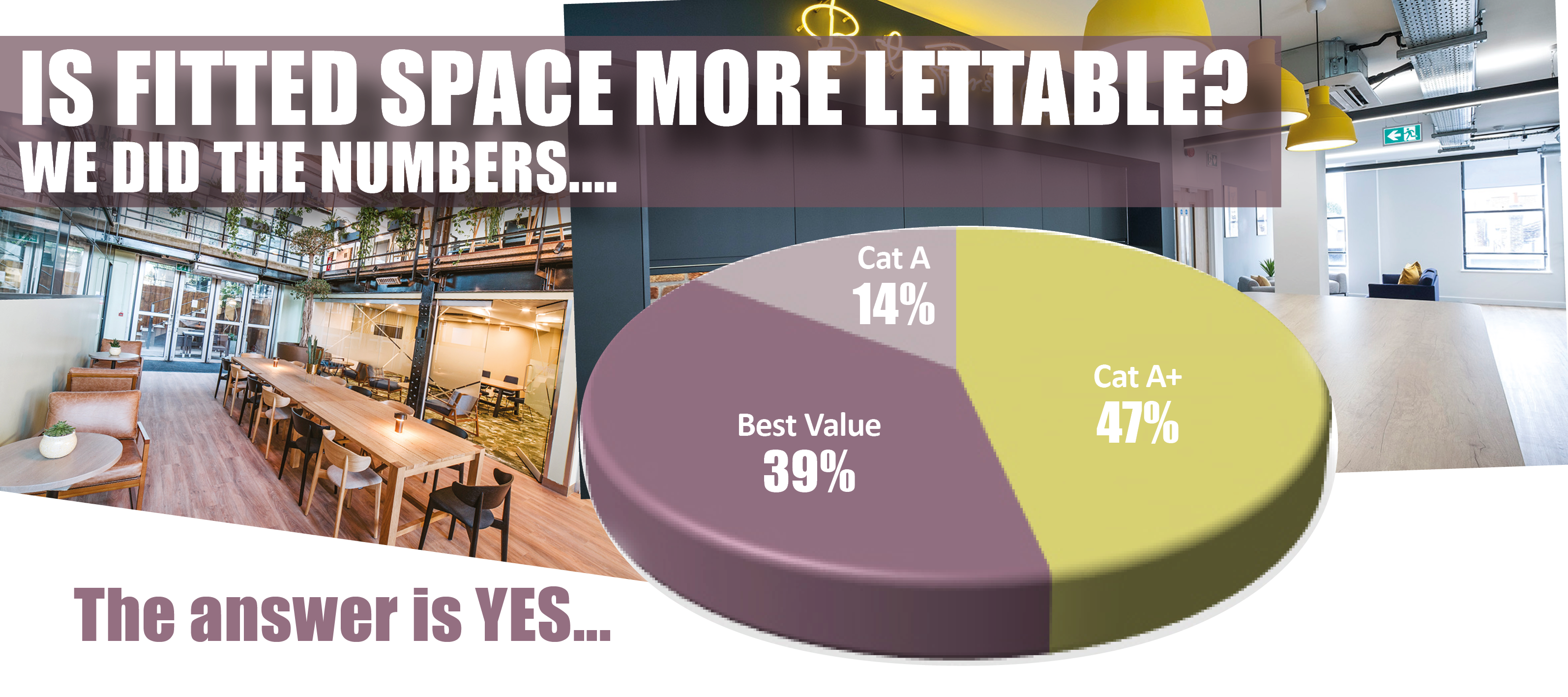

In the west London office market, our deals research shows that in 2022, a total of 176 deals were completed to office occupiers, totalling up to 538,030 sq ft, with the average deal size circa 3,000 sq ft. With half that space being fitted, the results are interesting but for those in the industry not a surprise.

Occupiers are attracted to the ready to occupy space with flexible leases, low cap-ex and speed of moving versus the traditional fit out process.

- Cat A+ (or fitted plug & play) – 82 deals, 47%

- Best Value Space (budget) – 68 deals, 39%

- Best in Class Cat A (clean canvas ready for tenants fit-out) – 26 deals, 14%

AshbyCapital let 22,931 sq ft at The Kensington Building W8 at around £85 per sq ft to EssilorLuxottica, the eye-wear manufacturer and designer business, owner of brands such as Ray-Ban and Oakley. The company has taken the entire second floor of the development, which completed last year and is the first new headquarters office building in Kensington in more than 35 years. The development comprises 94,734 sq ft of office space and over 12,000 sq ft of landscaped terraces, designed by Gillespies Landscape Architects. The building sources all its electricity from renewable sources, and re-purposing the building’s existing frame reduced CO2 emissions by around 30% compared to a typical new-build office building.

Linnaeus Veterinary has taken an 11,650 sq ft office building at 70 Chancellors Road in Hammersmith for £40 per sq ft. The wider planning use ‘class E’, introduced just over 2 years ago, has opened up new opportunities for struggling offices allowing uses such as medical and children’s nursery which would have otherwise required full planning permission. Linnaeus have over 57 veterinary practices across the UK & Ireland.

Federated Hermeshas instructed JLL to sell three offices in Greater London for £195.2 million.

The Landmark portfolio comprises 500,000 sq ft of offices. The guide price reflects a net initial yield of 8.15% and a capital value of £386 per sq ft.

The buildings are: 162,249 sq ft at Wimbledon Bridge House SW19, 200,452 sq ft at 26-28 Hammersmith Grove, W6, and 142,402 sq ft at Chiswick Tower. The portfolio is being dubbed the “Landmark” as each building is a well- known prominent office adjacent to a key London transport interchange in Wimbledon, Hammersmith and Chiswick respectively.

As a whole, the buildings are multi let to 29 tenants generating a weighted average unexpired lease term of 5.8 years to lease expiries and 2.3 years to nearest terminations, based on the contracted rent.

The total market rent reflects an overall office rent of £36.67 per sq ft

The Oak Group who purchased 50 Brook Green in 2019, have sold the 40,000 sq ft office freehold to an undisclosed US Fund having gained planning for change of use from office to 33 residential units.

In Fulham, Frost Meadowcroft completed the Freehold Investment Sale for an undisclosed client at 17 Heathmans Road, Fulham of 6,933 sq ft for £2.4 million to Selective Marketplace Ltd with a yield of 4.9%.